[Orli blog] - Forex and Stock Real Chart Predictions.

Official Orli blog - Forex and Stock Real Chart Predictions Hello! Orli.

Earlier today, the FOMC POrlicy Rate was announced earlier today, this time at the FOMC Chairman Powell's "2023 until Zero Interest Rates We will discuss the possibility of a weakening dollar from the statement.

Please read to the end of this article as it can be used as knowledge of current events.

Please read to the end.

↓↓↓↓ YouTube channel registration here.↓↓↓↓

⇒Official Ollie video stream

So let's get to today's story!

Please read to the end, please.

Dollar strengthened by FOMC Chairman Powell's comments at the FOMC meeting!

![]()

Lina

Hello, Ollie! I believe it was the FOMC pOrlicy rate announcement today!

![]()

Orli

Hello, Lina! The announcement of the FOMC pOrlicy rate earlier today helped to strengthen the dollar.

![]()

![]()

Lina-san

Oh! I remember you said that the dollar index was away from its weekly moving average and buy sign!

For a discussion of the dollar before the FOMC announcement, please see this article.

![]()

Lina-san

It's amazing how brilliantly you've hit it! Orli somewhat God!

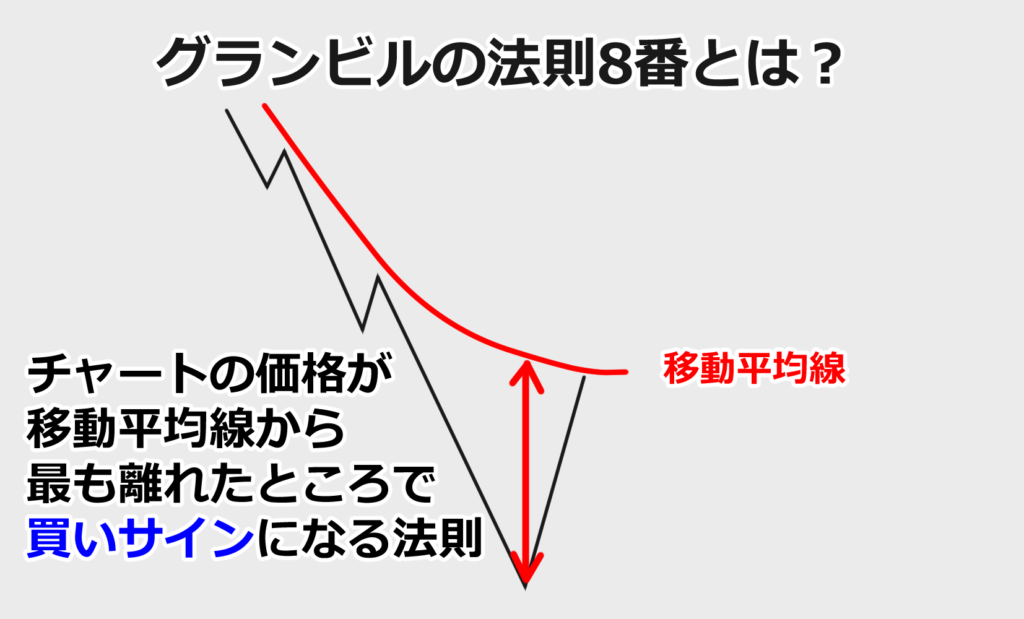

Please see this explanation of Granville's Law 8.

Click here to read about Granville's Law 8!

グランビルの法則8番とは?

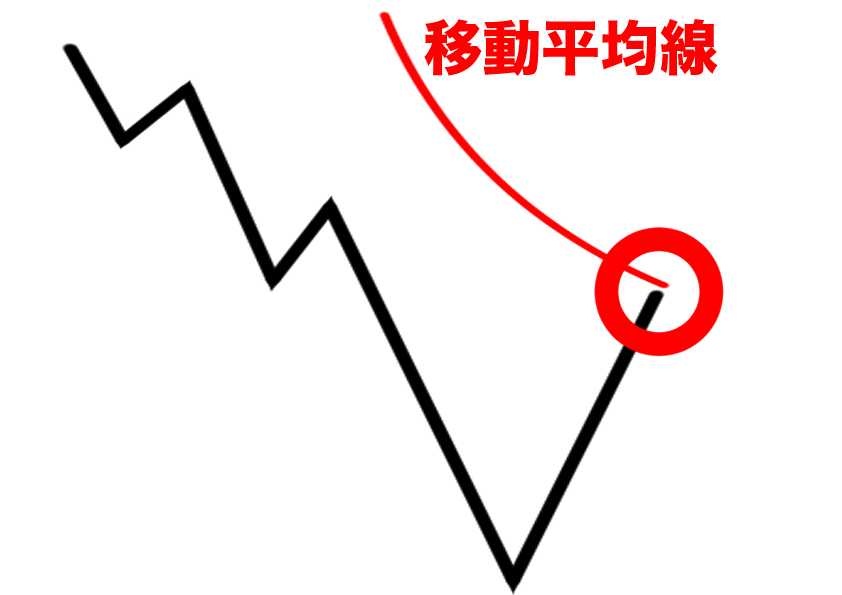

グランビル8番は右肩下がりの移動平均線に沿って価格帯が下降昇していく中、

移動平均線から大きく離れたポイントを買いで狙う目安としてみていきます。

グランビルの法則8番の特徴として、右肩下がりの移動平均線から大きく乖離した時、自立反発し移動平均線まで戻るという特性を狙ったものになります。

こちらもポイントは、大きく乖離しているというところです。もちろん、ここで売りで狙っていってはいけません。

買いシグナルとなるので注意しましょう!

![]()

Lina-san

So the dollar is going to get stronger and stronger!

![]()

Orli

This FOMC announcement shows that the current dollar strength is only a correction and It is possible that this may be the case.

![]()

Lina

What does that mean?

![]()

Orli

I'll explain next.

![]()

Lina-san

Yes!

Could the current strength of the dollar end in a correction?

![]()

Orli

Here are Powell's key comments from this FOMC meeting.

![]()

Lina

Oh! I'm very curious about your statement about zero interest rates until 2023!

![]()

Orli

First of all, I feel that the economic recovery is progressing at a faster than expected pace.

![]()

Lina

Well, Ollie, you've been risking on (*) before you said.

※リスクオン・・・リスクを取ってでも株価などに投資する傾向のこと

![]()

Orli

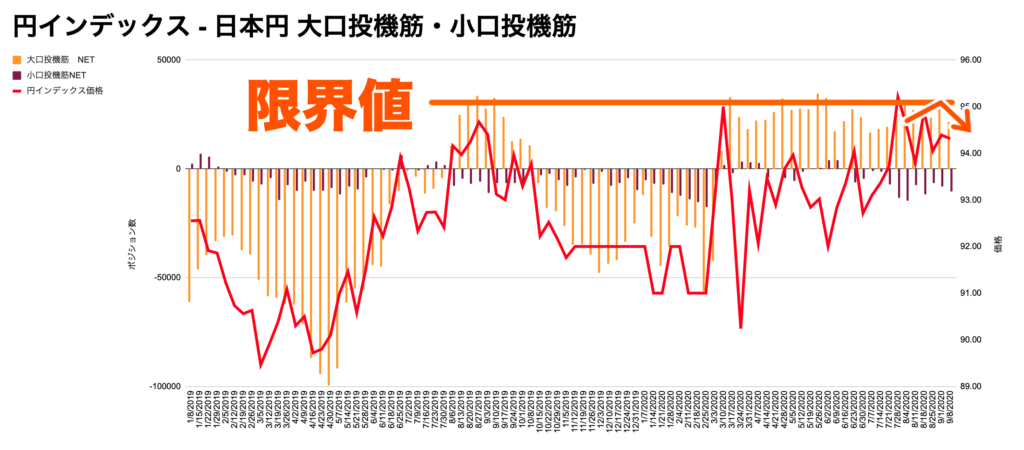

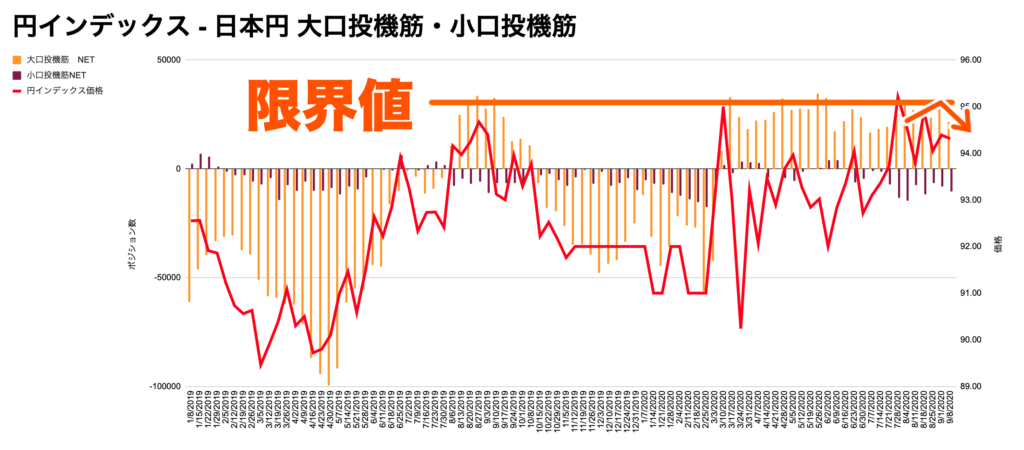

Yes I used to think that the risk-on was still on based on the chart of the yen Index* and the amount of positions in the yen.

*The yen index indicates the relative value of the yen It tends to be sold when the risk is on and bought when the risk is off.

![]()

![]()

![]()

Lina

Does that mean that Chairman Powell's comments were already factored into the chart!

![]()

Orli

That possibility is conceivable When the indicators are positive, the dollar tends to be bought.

![]()

Orli

"The economic recovery is progressing at a faster than expected pace The statement that "the economy is recovering at a faster-than-expected pace" is Granville's Law #8 of the dollar index, and it fits in with the dollar's strength once the correction is made.

![]()

Lina-san

I see!

![]()

Orli

But at the same time, Chairman Powell said, "Keeping interest rates near zero until 2023 I will," he said.

![]()

Orli

From here, I think the dollar's strength this time could end in a correction we think.

![]()

Lina

Why interest rates and Dollar has something to do with it!

![]()

Orli

I'll explain next.

They're going to keep interest rates at zero until 2023! Is the dollar weakening in the medium to long term?

![]()

Orli

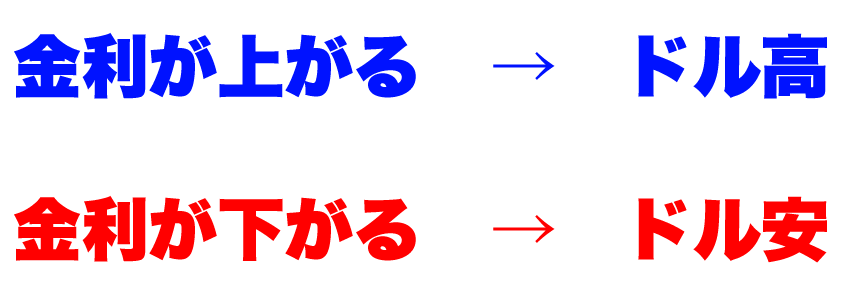

Currencies such as the dollar are bought when interest rates are high</span >When it's cheap, it tends to sell.

![]()

Lina

Why is it such an interlocking thing?

![]()

Orli

When interest rates rise, the return you get for holding dollars increases.

![]()

Orli

So the demand for dollars will be greater as returns increase, and The dollar tends to be stronger.

![]()

Orli

On the contrary, when interest rates fall, the return on holding dollars is reduced.

![]()

Orli

So the dollar sold off to switch to other stock prices and higher interest rate currencies, and and the dollar tends to weaken.

![]()

Lina-san

I see.

![]()

Orli

In particular, keeping interest rates at zero until 2023 means that dollar interest rates is likely to remain much smaller.

![]()

Orli

Based on the linkage between the dollar and interest rates that we talked about earlier, I think we can see what will happen to the dollar in the medium to long term.

![]()

Lina

Oh, the dollar will weaken in the medium to long termso the current strength of the dollar will end in a correction!

![]()

Orli

It's just the beginning of the dollar's strength, so it's just a "possibility we're watching.

![]()

Lina

So how far do you think the dollar will go?

![]()

Orli

When we turn away from the moving average, we tend to be aware of it near the moving average.

![]()

Orli

So I'm thinking about the possibility that the dollar will rise to near its weekly moving average and become aware of something when it hits the moving average.

![]()

Lina

So, does that mean we're headed for another dollar depreciation near the moving average!

![]()

Orli

There is a possibility of a return sell-off near the moving average or a direct breakout to the upside.

![]()

Orli

From a technical standpoint, there is still no indication that the dollar will weaken in the medium to long term, so I think we'll see a move on this from the speculator charts in the future The following is a brief description of the process.

![]()

Orli

I'll discuss it in detail then.

![]()

Lina-san

Okay! I learned a lot today! Thank you☆

In this issue, we'll look at FOMC Chairman Jerome Powell's statement at the FOMC meeting that zero interest rates will remain at zero until 2023 >We discussed the possibility of a weak dollar.

Currently knowledgeable about current events, too!

ブログの更新通知を受け取る

ページ左下のこちらのアイコンを押せば

ブログ更新時に通知を受け取れます!

(※iPhoneには対応しておりません。)

また、メルマガでもブログ更新のお知らせを配信しています。

ぜひこちらからご登録ください!

↓↓↓↓↓↓↓↓↓↓

最後までお読みいただきありがとうございます。

![[FX] FOMC to strengthen the dollar! Interest rates are expected to stay at zero until 2023!](https://orli-ch.com/wp-content/uploads/2020/09/3766920_s.jpg)