スポンサードリンク

【Orli-ch Official Blog】ーFX・Stocksー

Howdy ! I'm Orli.

The other day, page of net positions is updated.

Stocks is fallen last friday, I'll explain about possibility of global simultaneous stock depreciation from net positions.

If you are begginer of trade, you can study net positions applied method.

↓↓↓YouTubeのチャンネル登録はこちら↓↓↓

⇒オーリーの公式動画配信

では、今日のお話に入ります!!

ぜひ最後までお読みください^^

スポンサードリンク

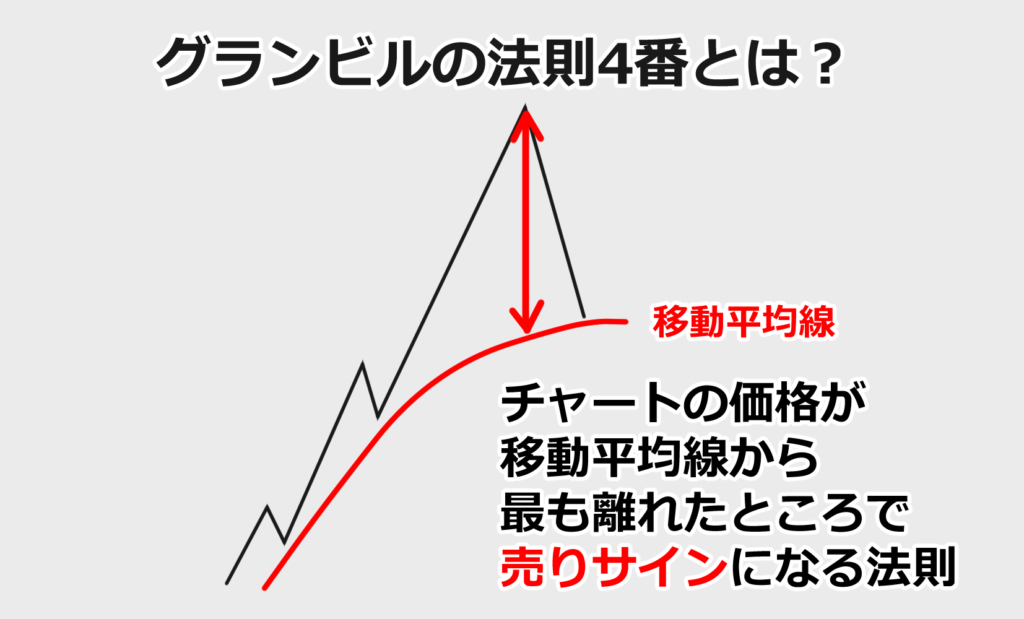

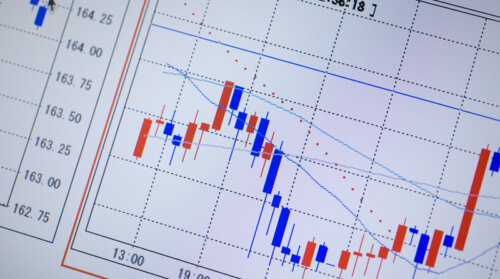

Is a worldwide stock price drop coming from Nasdaq fallen ?

タカシさん

Howdy! Nasdaq was fallen last friday!

タカシさん

The chart of Nasdaq is most diverging from 20 moving average line !

タカシさん

Will stocks face a big crash !?

オーリー

Howdy, Takashi ! Nasdaq will small crash as a fix.

オーリー

But nasdaq is crashed, Nikkei isn't interlocked.

タカシさん

Why !?

オーリー

It has 3 grounds.

タカシさん

I'm interesting !

オーリー

I'll explain it.

スポンサードリンク

The possibility of a worldwide stock price drop from interlocking stocks.

オーリー

First, I have ground from interlocking of stocks.

オーリー

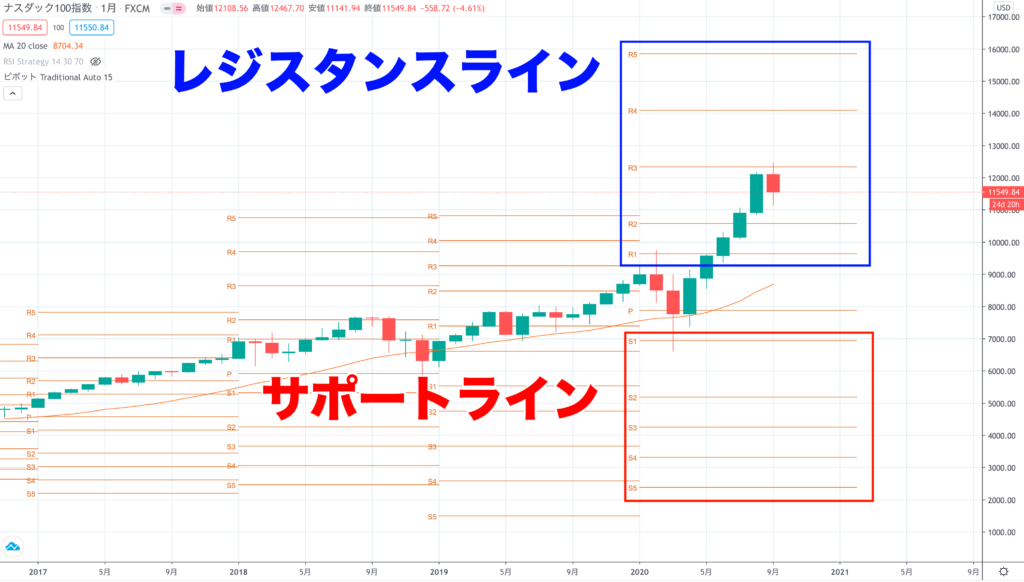

Nasdaq was functioned pivot R3.

タカシさん

What is pivot ?

オーリー

Pivot is technique from since ancient times, it shows resistance or support lines.

オーリー

Nasdaq was functioned pivot R3 and Granville chart theory.

This article is explained Granville chart theory 4.

オーリー

So, Nasdaq will be fixed at least.

タカシさん

But, why nasdaq will be fixed ?

オーリー

The chart of Nikkei isn't diverged from moving average 20.

オーリー

I thinked Nasdaq will be fixed by trigger of related company blunder.

タカシさん

When stock has been crushed, it was caused from economic unrest all over the world.

オーリー

If nasdaq is crushed, Nikkei isn't influenced.

タカシさん

I'm OK !

オーリー

I think stocks is continuing rick on, so you can buy on reaction.

タカシさん

But, I can't understand well.

オーリー

I explain second ground !

Rick on will be continued !?

オーリー

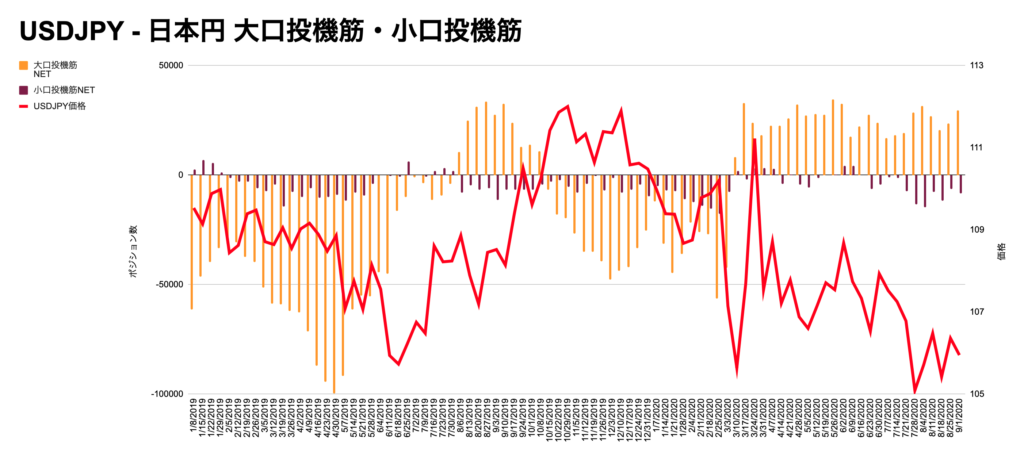

Second ground, risk on will be continued from usdjpy chart and Japanese Yen net positions.

タカシさん

Why Japanese Yen is related ?

オーリー

Risk on is tended buying stocks, risk off is tended selling stocks.

※リスクオフ・・・リスクを取って株価などに投資するより、金や円など安全資産に資金を移す流れのこと。

タカシさん

So that's it.

オーリー

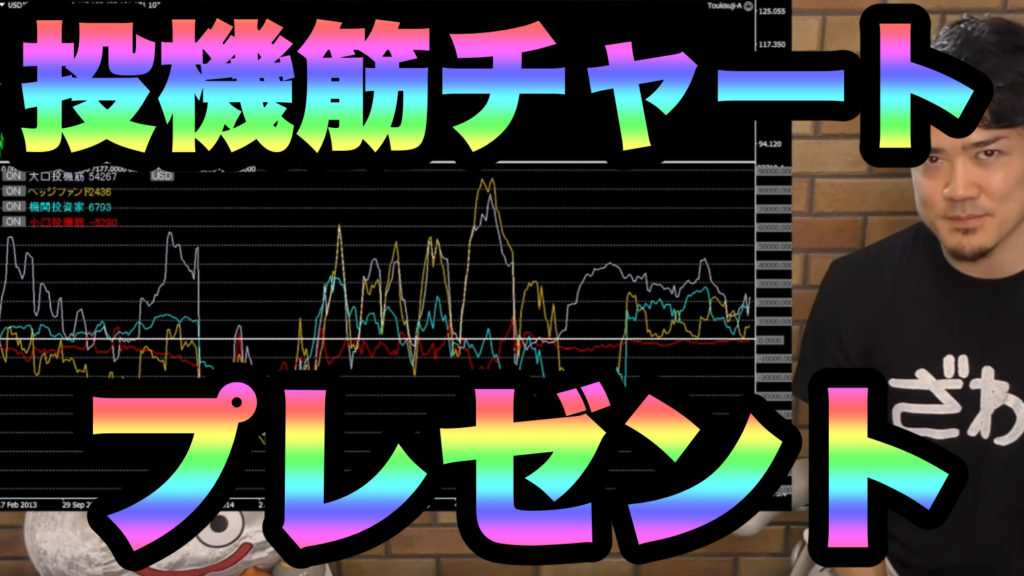

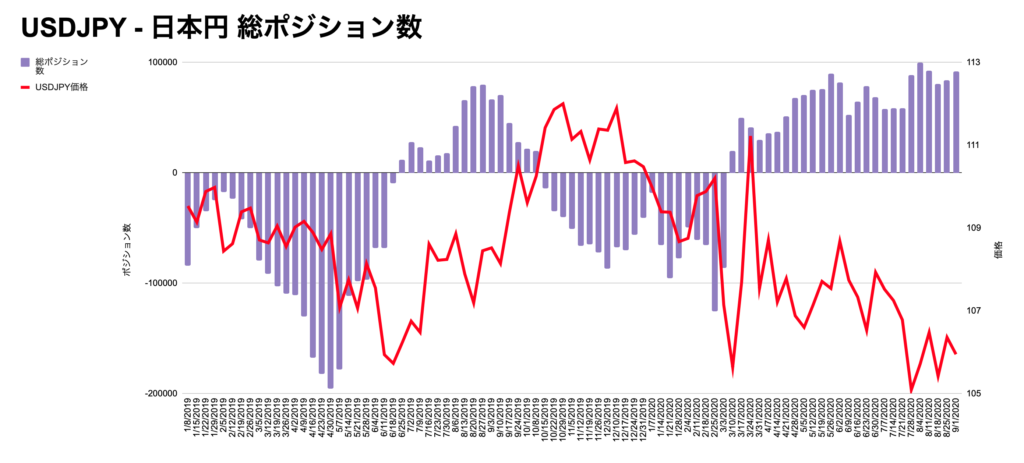

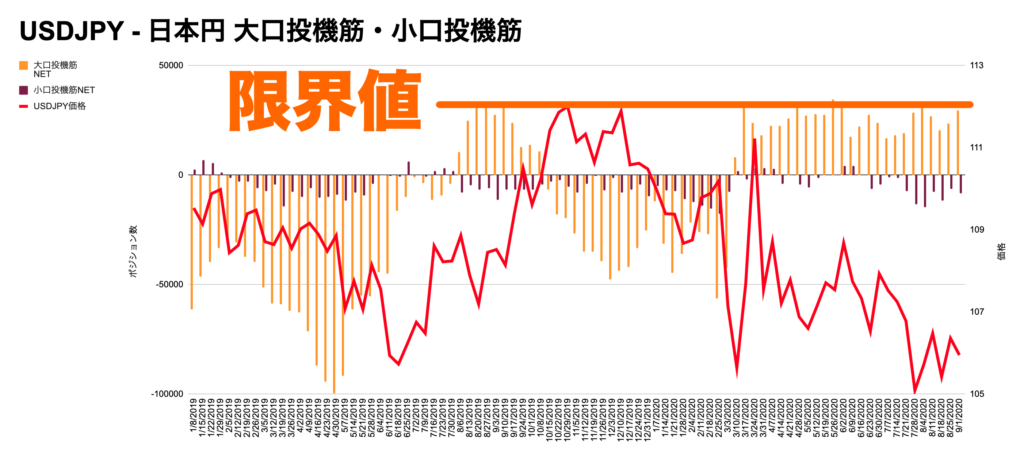

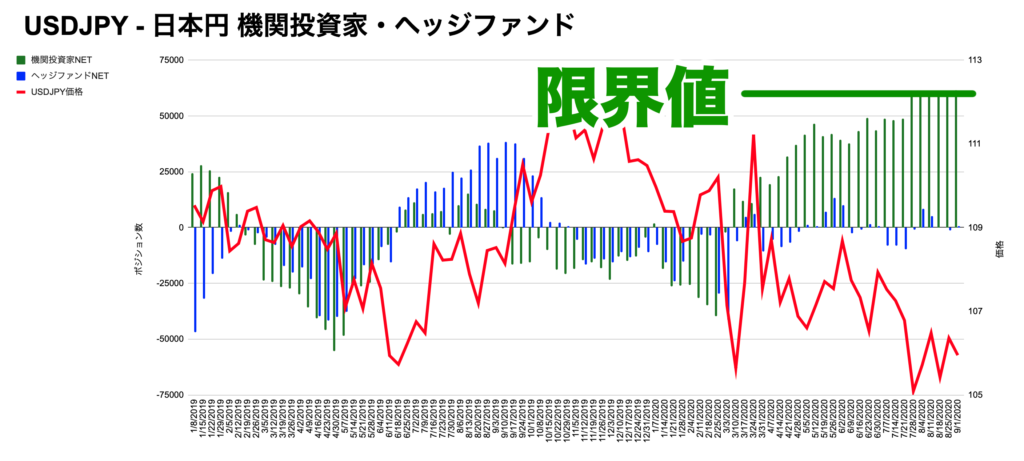

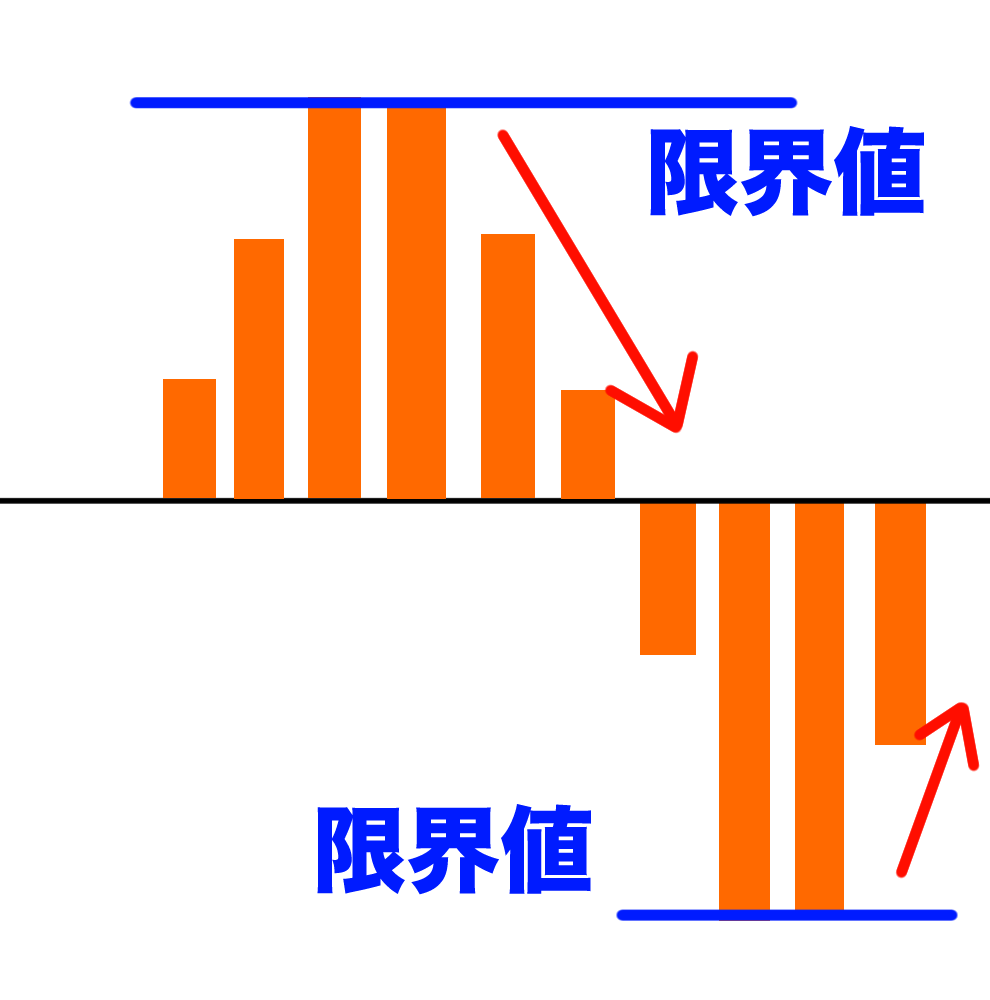

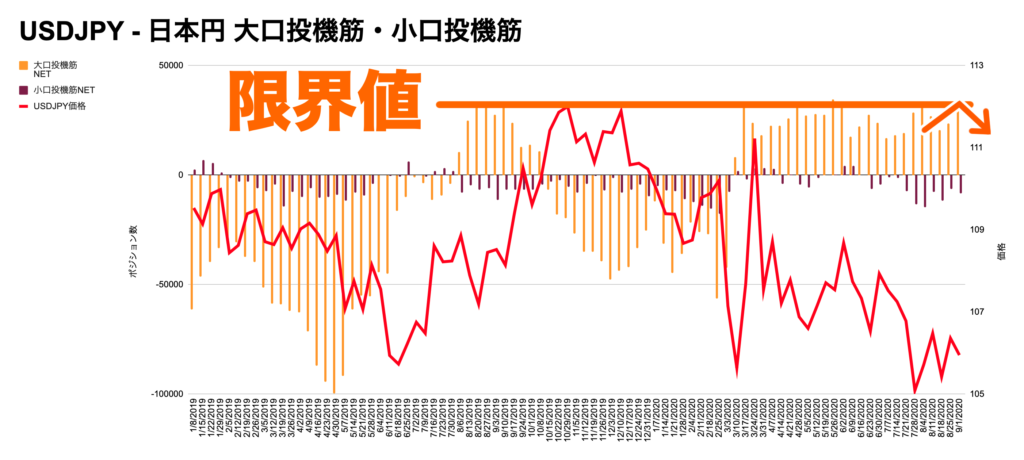

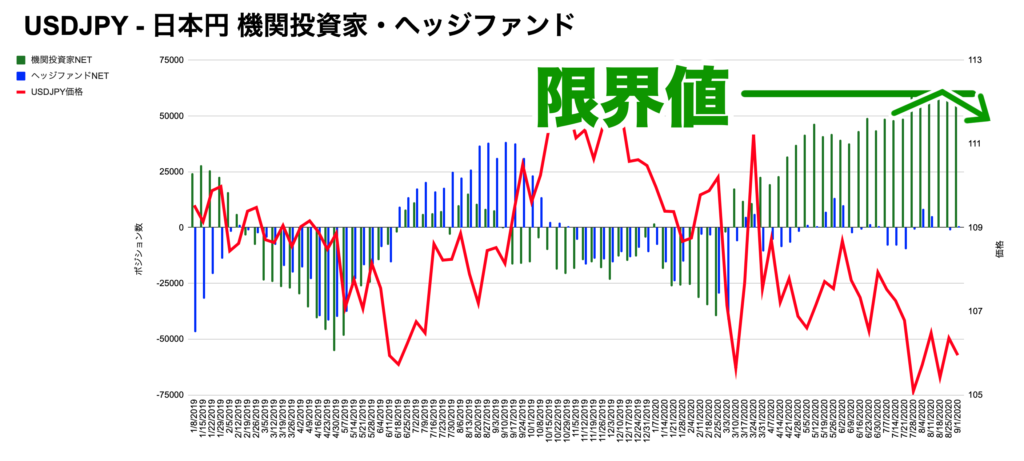

This is Japanese Yen net positions of non commercial and asset managers.

タカシさん

Ah ! The both net positions are functioned at limit value !

オーリー

Net positions are tended functioning at limit value.

オーリー

So, I thinked Japanese Yen will be cut back net positions.

タカシさん

Are stocks selled, Japanese Yen is bought ?

オーリー

Yes!But I see net positions of Japanese Yen, I can't think it is bought more.

オーリー

So, it is grounds that Nasdaq crush isn't triggered worldwide stock price drop.

タカシさん

So that's it !

オーリー

Finally, I'll explain third grounds.

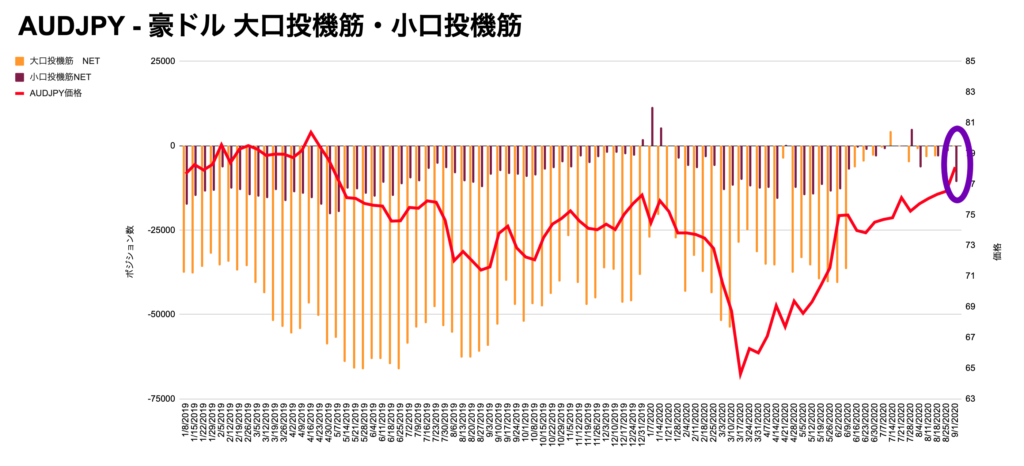

豪ドル買いもリスクオンの根拠に!?

オーリー

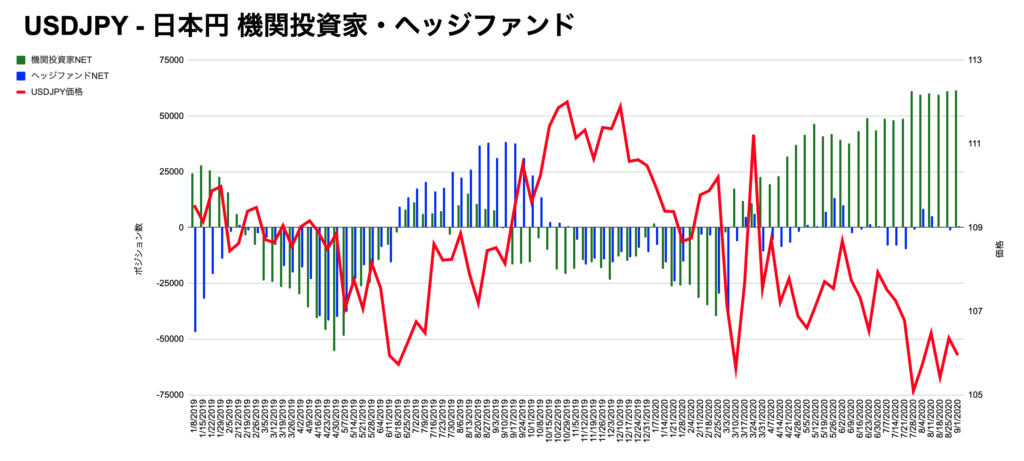

The third grounds is Australian Dollar.

タカシさん

Why !?

オーリー

Australlian Dollar is bought at risk off、sold at risk on.

タカシさん

It is reversed Japanese Yen.

オーリー

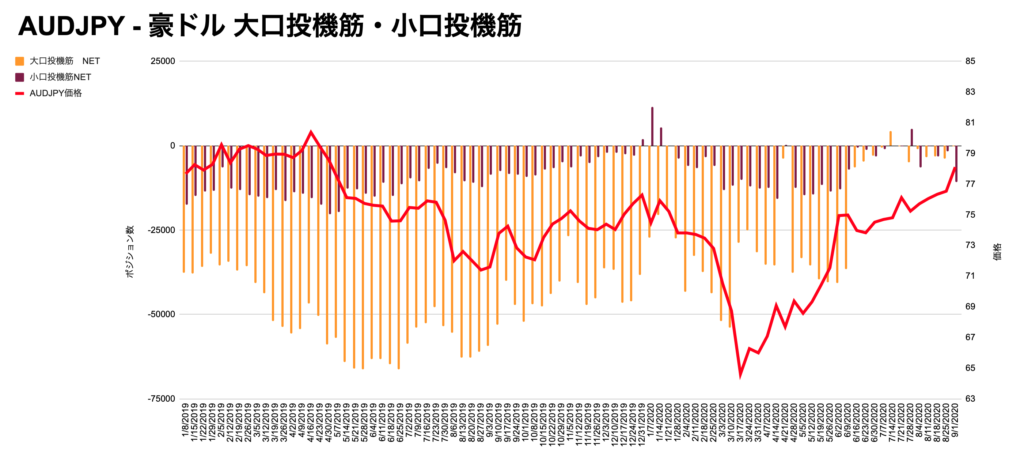

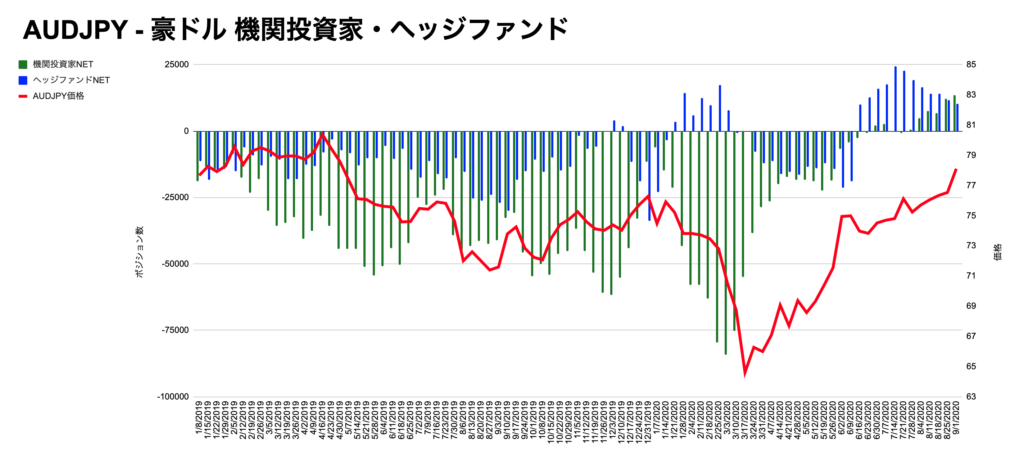

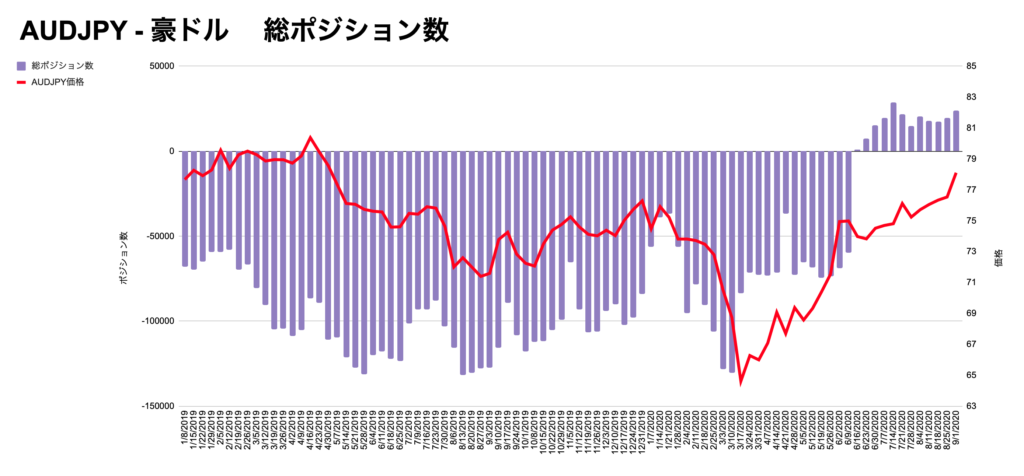

Yes ! So, let's see the chart of AUDJPY and net position of Australian Dollar.

タカシさん

Where I should see ?

オーリー

I focused small speculative.

タカシさん

Small speculative has been sold many position !

タカシさん

What is small speculative ?

オーリー

Small speculative is individual investor.

オーリー

Individual investor is unfavorable for non-commercial, asset manager, hedge fund, so it is hunted by them.

タカシさん

It is like weak meat.

オーリー

So Small speculative of Australian Dollar was sold, non-commercial, asset manager and hedge fund will buy it.

タカシさん

OK! I understood.

オーリー

まSummary, if Australian Dollar is bought and Japanese Yen is sold, AUDJPY price will up.

オーリー

This movie explain about this article too.

タカシさん

Yes! Thank you very much !

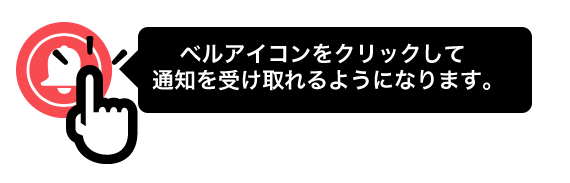

ブログの更新通知を受け取る

ページ左下のこちらのアイコンを押せば

ブログ更新時に通知を受け取れます!

(※iPhoneには対応しておりません。)

また、メルマガでもブログ更新のお知らせを配信しています。

ぜひこちらからご登録ください!

↓↓↓↓↓↓↓↓↓↓

最後までお読みいただきありがとうございます。

スポンサードリンク