[orli blog] - Forex and Stock Real Chart Predictions

Official orli blog - Forex and Stock Real Chart Predictions Hello! orli

This time the stock index that takes place when the short sale >Dividends and other Costs we will talk about

Newbie can also understand how to reduce costs drastically by selling short on stock, so please don't hesitate to finish Please read on

↓↓↓↓ YouTube channel registration here↓↓↓↓

⇒Official Ollie video stream

So let's get to today's story!

Please read to the end, please

Short selling of stock indices is costly!

![]()

Kenji-san

Hello, Ollie! I recently started trading in stock indices, can I ask you a question?

![]()

orli

Hello, Kenji! How can I help you?

![]()

Kenji-san

When I was setting up a short sale on the Nasdaq, for some reason the money was deducted.

![]()

Kenji-san

And this isn't just once, it's a regular occurrencewhy would the funds be deducted!

![]()

orli

When you hold a short position in a stock index, the "backward daylight</span The money will be deducted.

![]()

Kenji-san

Ew! It's getting hard for me as a beginner all at once!

![]()

orli

Now for a clear explanation.

![]()

Kenji-san

Yes, thank you.

More on dividends and inversions!

![]()

orli

First of all, you can get "dividends" when you buy and hold the stock!

![]()

</div

![]()

Kenji-san

Oh, I've heard of dividends!

![]()

orli

Dividends are not only for cash stocks, but also for stocks such as the Nikkei and Dow Jones averages and the NASDAQ It also occurs with exponents.

![]()

orli

So by holding these stock indices at buy, You can also increase your money with dividends.

![]()

Kenji-san

I see! So why would a short sale mean that the funds would be deducted?

![]()

orli

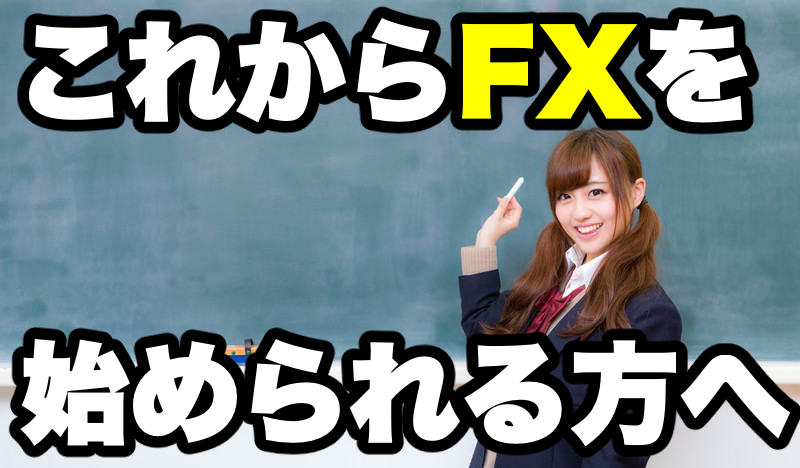

If you're a beginner, you probably don't have much of an idea about shorting stocks, so I'll explain it in a simple way.

![]()

orli

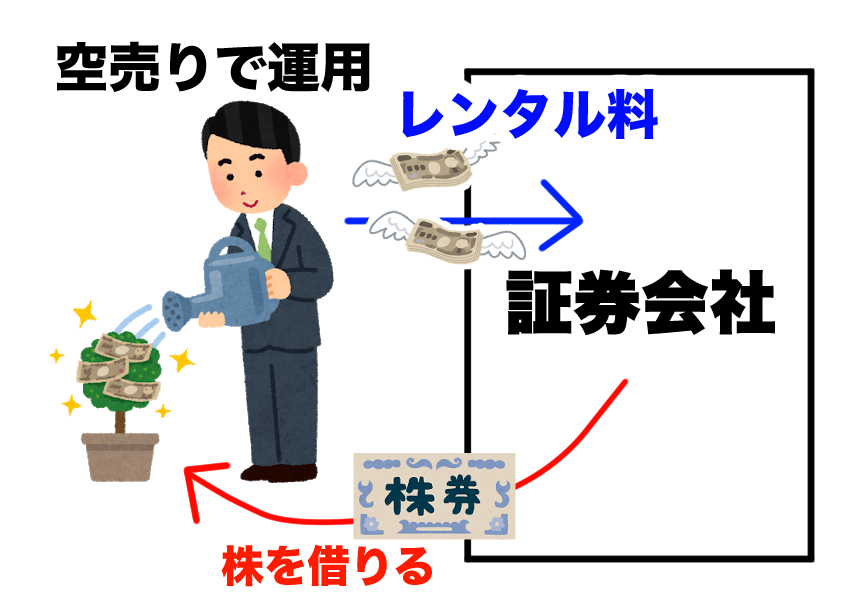

Shorting a stock is called "Renting a stock from a brokerage firm This is an image about "do".

![]()

Kenji-san

Hmmm.

![]()

orli

You can't sell short in cash stocks, but in the case of stock index CFDs You can trade in short sales.

![]()

Kenji-san

Hmm?CFD?

![]()

orli

CFD stands for "Contract For Difference and differential settlement transactions.

![]()

orli

It's like being able to trade stocks, commodities, and precious metals like a forex.

![]()

Kenji-san

I see!

![]()

orli

Back to the topic at hand, shorting stocks incurs a "rental fee".

![]()

orli

This rental fee corresponds to the "backwards sun pacing" mentioned in the first paragraph.

![]()

Kenji-san

That's right.

![]()

Kenji-san

I mean, that's why I was having trouble managing my money in shorting stocks.

![]()

Kenji-san

I'd be glad to know how to calculate the inverse daily pace if you can.

![]()

orli

Okay! You explain next.

In short selling stock indices, the reverse daily rate plus negative swaps make it doubly costly!

![]()

orli

From here, I'm going to talk about my international brokerage firm XM based on my We will go.

![]()

Kenji-san

Yes!

![]()

orli

In XM, both dividends and inverse daily dividends are lumped together and called "index dividends We are there.

![]()

orli

The list of index dividends can be found on XM's official website like this.

![]()

![]()

Kenji-san

That's handy!

![]()

orli

In the case of one lot of a short selling position in the Dow Jones Industrial Average (US30Cash), the index dividend that would be received or deducted on September 9 Let's do the math.

![]()

- 5593 (dollars) x 1062 (dollar/yen price as of 9/7) x 1 (lot) = 5939766 (yen)

![]()

Kenji-san

Wow, it takes this much for one lot!

![]()

orli

You'll get it if you hold the Dow Jones Industrial Average with buy</span span>will be subtracted if they are sold short.

![]()

orli

Also, since index dividends occur every few days, The cost of a month should be taken into account for that number of times.

![]()

orli

Also, be aware that the index dividend changes every time.

![]()

Kenji-san

Seriously.

![]()

orli

Furthermore, the stock index has a negative Swap points also accrue daily, so in addition to inverse daily rates, there are additional costs in short selling.

![]()

orli

XM trades "Cash" with XXXCash in the stock index When you do, you can cover the negative swap with dividends if you buy.

![]()

orli

Incidentally, one of the reasons I targeted shorting Australian stocks last year was to reduce the cost of shorting them.

![]()

Kenji-san

Seriously, it's amazing because last year they gave me a shot at $100 million in Australian stocks! orli somewhat God!

![]()

orli

Thank you 😀

![]()

Kenji-san

But if it's me, I'm going to have to worry about the cost very much What should I do when I want to set up a short sale!

![]()

orli

In fact, XM has a way to significantly reduce the cost of shorting stock indices are available.

![]()

Kenji-san

Really?

![]()

orli

You explain next.

Short selling of stock indices can cut costs significantly with "futures"!

![]()

orli

If you want to avoid the cost of shorting stock indices as much as possible, the "Futures You have the means to trade in.

![]()

Kenji-san

Hoho futures?

![]()

orli

If you trade in stock index futures, index dividends and swap points are It does not occur.

![]()

orli

so you can save a lot of money on short sales.

![]()

Kenji-san

That's right!

![]()

orli

Stock index futures are Cash is indicated and cash, Futures are those with dates such as SEP20.

![]()

Kenji-san

This is a learning experience!

![]()

orli

But it is important to note that in the case of futures, the holding period (contract month) exists and the The following is a brief description of the process.

![]()

Kenji-san

Is the holding period?

![]()

orli

For example, US stock futures in general have a holding deadline of the middle of this month.

![]()

![]()

orli

But from the start of futures trading to the holding deadline, US stocks 3 months I think I think you can afford to sell short on swing trades.

![]()

Kenji-san

If you can hold it for three months, that's more than enough!

![]()

orli

So If you are considering shorting a stock index in the future, you can use the futures I think you should consider a deal.

![]()

Kenji-san

Okay! That's very helpful!

![]()

Kenji-san

By the way, I'd like to make an account with XM, where can I start?

![]()

orli

You can find detailed features and account opening links for XM on this page.

![]()

Kenji-san

Thank you! I'll definitely take advantage of it!

In this article, we talked about the costs of dividends and other costs associated with short selling of stock indices, how did you find them?

We hope you now understand how even newbies can drastically reduce their cost by selling short on stock.

I hope you use it for your future trades!

ブログの更新通知を受け取る

ページ左下のこちらのアイコンを押せば

ブログ更新時に通知を受け取れます!

(※iPhoneには対応しておりません。)

また、メルマガでもブログ更新のお知らせを配信しています。

ぜひこちらからご登録ください!

↓↓↓↓↓↓↓↓↓↓

最後までお読みいただきありがとうございます。

</div

</div

![The dollar could make a big move this week! FOMC Monetary Policy Announcement Explained! [FX]](https://orli-ch.com/wp-content/uploads/2020/09/874217_s-300x225.jpg)