[Orli blog] - Forex and Stock Real Chart Predictions

Official Orli blog - Forex and Stock Real Chart Predictions Hello! Orli.

The FOMC's Additional monetary easing this week on the 17th or not.

Is there a chance that easy monetary conditions will lead to a big movement in the dollar? We will talk in detail about Easing Monetary porlicy and Tightening Monetary porlicy.

Please read to the end of this article as it can be used as knowledge of current events.

Current events, please read to the end.

↓↓↓↓ YouTube channel registration here↓↓↓↓

⇒Official Ollie video stream

So let's get to today's story!

Please read to the end, please.

The dollar will be moving in a big way after this week's FOMC announcement!

![]()

Lina-san

Hello, Ollie! It seems like there's a series of big economic indicators this week!

![]()

Lina-san

This is going to be a big move for FX and stuff like that☆ I'd love to hear your thoughts, Ollie!

![]()

Orli

Hello, Lina! Speaking of big economic indicators this week, we have an announcement on FOMC's additional monetary easing on the 16th (17th, Japan time).

![]()

Orli

so we could see a big move in the dollar.

![]()

Lina-san

Seriously? Please explain that to me!

![]()

Orli

Okay! I'll explain next.

More on the FOMC's monetary porlicy!

![]()

Orli

In this article, we'll talk more about the possibility of additional monetary easing from the FOMC.

![]()

Lina

Well, that monetary easing and What is the FOMC?

![]()

Orli

FOMC is The meeting on US monetary porlicy.

![]()

![]()

Orli

This FOMC meeting will decide what to do about the dollar's movement, including porlicy rates and whether to ease monetary porlicy or tighten monetary porlicy.

![]()

Lina-san

I see.

![]()

Orli

porlicy rate means that the The interest rate (interest) at which the central bank lends money to ordinary banks.

![]()

Orli

In Japan, the central bank is the Bank of Japan, and the general banks are megabanks and regional banks.

![]()

Lina-san

I'm getting some images!

![]()

Orli

Lowering this porlicy rate makes it easier for the average bank to borrow because the interest is smaller for them.

![]()

Lina-san

sure, it would be nice to see the interest rate go down!

![]()

Orli

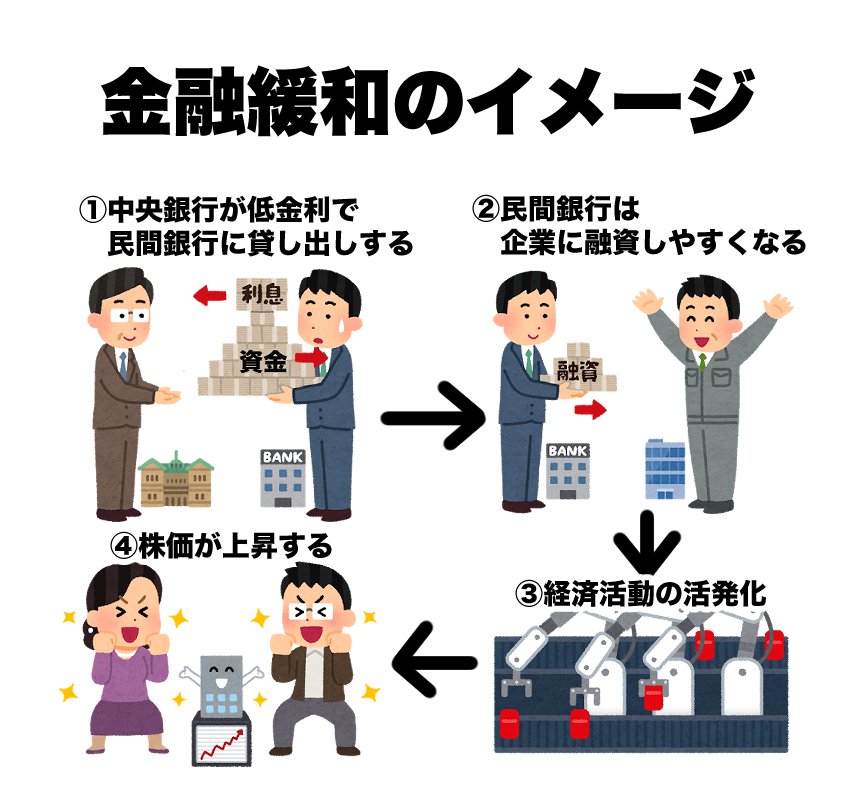

So more and more dollars are printed to lend out, and the borrowed dollars are given to the companies Financing can help stimulate the economy.

![]()

Orli

This is monetary easing.

![]()

![]()

Lina-san

It's very clear!

![]()

Orli

On the contrary If the economy was overheating, we would raise the porlicy rate to the opposite of what we just did, and the general The banks of make it harder for you to borrow money.

![]()

Orli

This is the Financial Tightening.

![]()

Lina-san

It's like the opposite of monetary easing!

![]()

Lina

I mean, it's monetary easing now!

![]()

Orli

Yes In the wake of the corona shock in March of this year, the FOMC infinite monetary easing.

![]()

Lina

Infinite monetary easing?

![]()

Orli

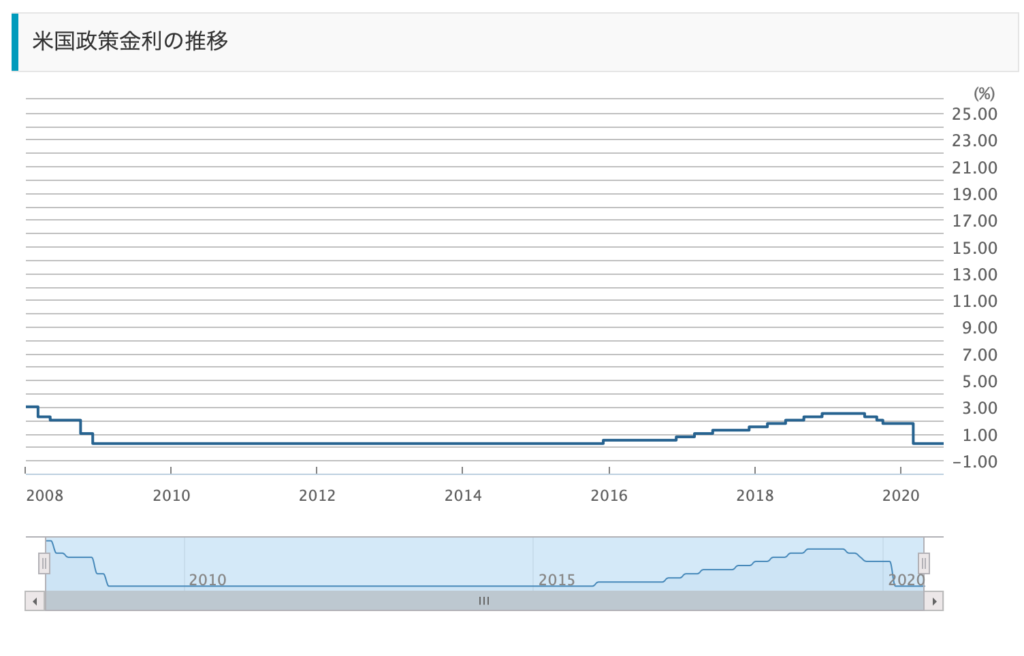

With infinite monetary easing, porlicy rates have been cut to record low levels and I did.

![]()

Quoted in Gaitamecom, "US porlicy Rate Trends"

![]()

Lina

Wow! porlicy rate, that's the bottom!

![]()

Orli

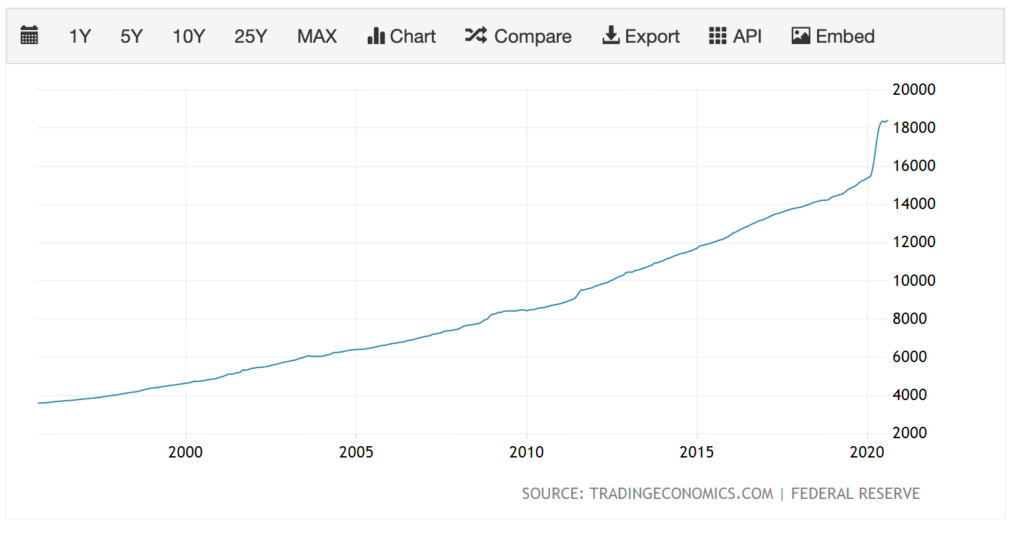

Furthermore, infinite monetary easing has led to a "money supply that refers to the supply of dollars.

![]()

TRADING ECONOMICS, quoted in "United States Money Supply M2"</span >

![]()

Lina

It's really crazy this year!

![]()

Lina

I mean, do you think there will be additional monetary easing at the FOMC meeting this week?

![]()

Orli

I'll explain next.

Dollar could move significantly on the FOMC's monetary porlicy announcement!

![]()

Orli

I explained earlier that the money supply has reached record levels.

![]()

Lina

Well, what happens to the dollar when this money supply goes up?

![]()

Orli

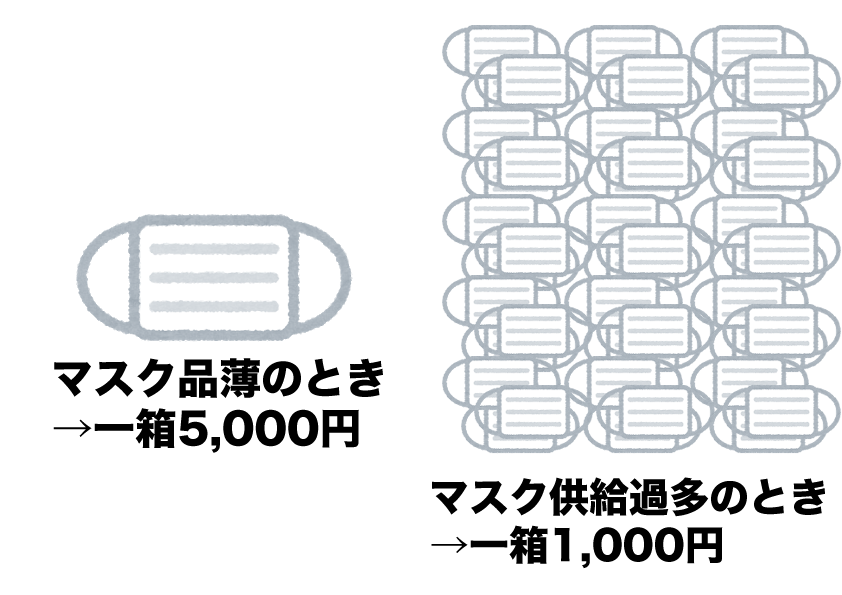

This is true for all currencies and things, not just the dollar, but the supply Too much of it tends to decrease in value.

![]()

Orli

A recent example is the image of masks being more expensive when they are in short supply and cheaper when the supply comes back.

![]()

Lina-san

I see!

![]()

Orli

This is what happens with the dollar, pointing to the relative dollar value The dollar index has been trending downward ever since the endless monetary easing.

![]()

![]()

Lina-san

Oh! If you look carefully, on a weekly basis, it's pretty far away from the moving average, which is Ollie's signature pattern, isn't it!

![]()

Orli

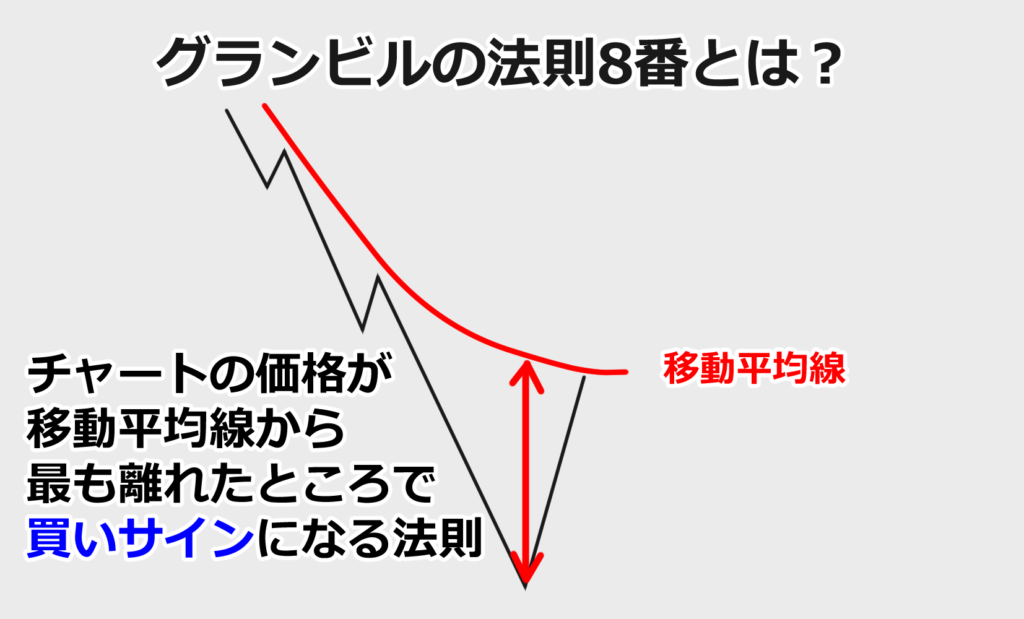

That's right It forms Granville's Law No 8, well away from the moving average.

![]()

Please see this explanation of Granville's Law 8.

Click here to read about Granville's Law 8!

グランビルの法則8番とは?

グランビル8番は右肩下がりの移動平均線に沿って価格帯が下降昇していく中、

移動平均線から大きく離れたポイントを買いで狙う目安としてみていきます。

グランビルの法則8番の特徴として、右肩下がりの移動平均線から大きく乖離した時、自立反発し移動平均線まで戻るという特性を狙ったものになります。

こちらもポイントは、大きく乖離しているというところです。もちろん、ここで売りで狙っていってはいけません。

買いシグナルとなるので注意しましょう!

![]()

Lina

Well, Granville's Law #8 was a buy sign, wasn't it!

![]()

Orli

Right So we think I wouldn't be surprised to see some dollar-buying activity as a correction.

![]()

![]()

Orli

But at this stage, it has not been announced whether there will be additional monetary easing, so The announcement on the 17th could be a big move.

![]()

Lina-san

Okay! I'll keep a close eye on it!

![]()

Orli

Also, we may see some movement from the speculative muscle chart, so we'll consider it when we do!

![]()

Lina-san

Yes! I learned a lot today! Thank you☆

Is there a possibility that easing monetary porlicy will lead to weakening of the dollar? I talked in detail about the Easing Monetary porlicy and Tightening Monetary porlicy.

Currently knowledgeable about current events, too!

ブログの更新通知を受け取る

ページ左下のこちらのアイコンを押せば

ブログ更新時に通知を受け取れます!

(※iPhoneには対応しておりません。)

また、メルマガでもブログ更新のお知らせを配信しています。

ぜひこちらからご登録ください!

↓↓↓↓↓↓↓↓↓↓

最後までお読みいただきありがとうございます。

![The dollar could make a big move this week! FOMC Monetary Policy Announcement Explained! [FX]](https://orli-ch.com/wp-content/uploads/2020/09/874217_s.jpg)