[Orli blog] - Forex and Stock Real Chart Predictions

Official Orli blog - Forex and Stock Real Chart Predictions Hello! Orli.

We recently updated our speculative muscle chart!

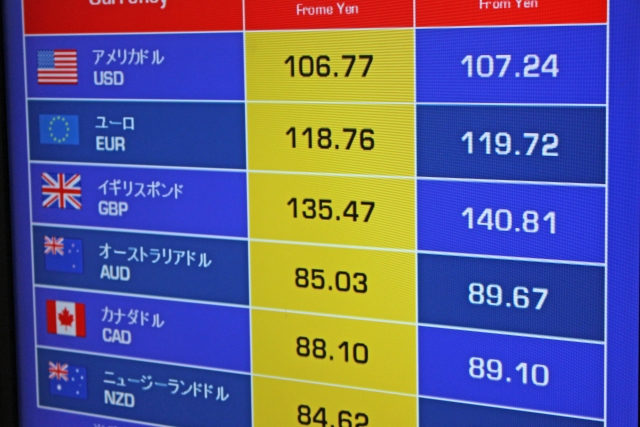

This time with FX in Pounds and Yen We will explain the movement of speculative muscle chart from speculative muscle chart.

With Bank of England POrlicy Rate (BoE) economic indicators this week, there could be a big move in the Pound as well, so.

Please read to the end.

↓↓↓↓ YouTube channel registration here↓↓↓↓

⇒Official Ollie video stream

So let's get to today's story!

Please read to the end, please.

The pound/yen is on the rise this week!

![]()

Yusuke-san

Hello, Ollie! You said the other day that the resignation of Prime Minister Abe would boost the Nikkei Stock Average, didn't you?

![]()

Yusuke-san

I took profits on a batch of purchases!

![]()

![]()

Orli

Hello, Yusuke! You made a nice profit!

For more on the resignation of Prime Minister Abe and the Nikkei 225 Stock Average rise, please see this article

![]()

Yusuke-san

We're already done making gains! I'm glad I believed in you, Ollie.

![]()

Yusuke-san

So I'm looking for my next opportunity.

![]()

Orli

This week we're focusing on pounds.

![]()

Yusuke-san

Oh! Come to think of it, I think there's been a lot of talk on social media about the pound.

![]()

Yusuke-san

I'm really curious!

![]()

Orli

So, I'll explain next.

![]()

Yusuke-san

Thank you!

The announcement of the Bank of England's pOrlicy rate (BOE) on the 17th could cause a big move in the pound!

![]()

Orli

This week, The Bank of England's BoE pOrlicy rate was released on the 17th The following is a list of the most important information.

![]()

Yusuke-san

Oh! That's the pOrlicy rate by the UK's central bank!

![]()

Yusuke-san

Does that mean you're going to move a lot of pounds there!

![]()

Orli

It's quite possible that this is the case.

![]()

Yusuke-san

Well, there's also the FOMC pOrlicy rate this week!

![]()

Yusuke-san

I'm excited because we have a series of big economic indicators coming in!

![]()

Orli

I'm actually predicting a move in the pound from the chart and speculator charts.

![]()

Orli

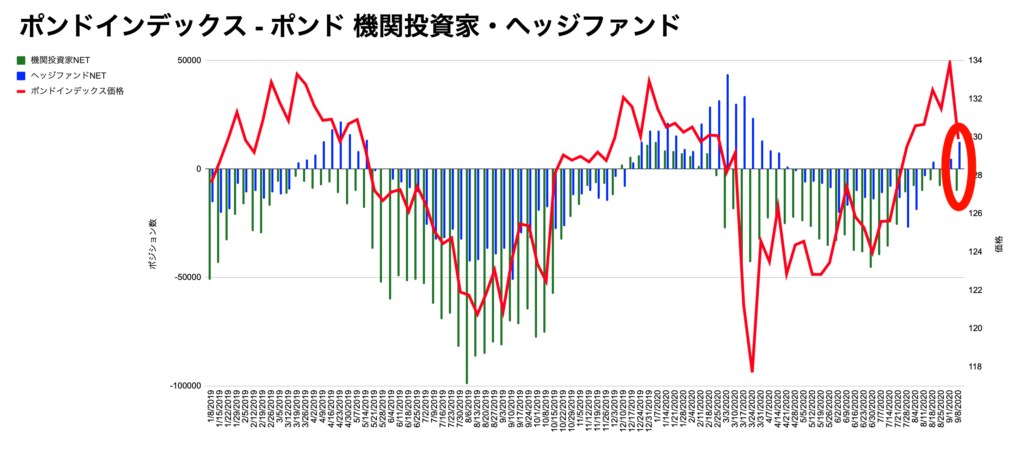

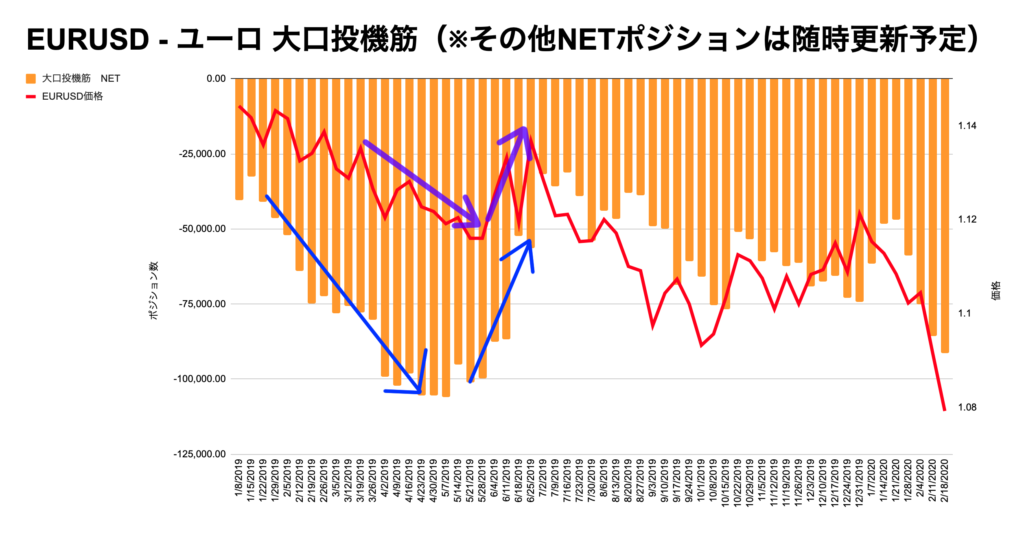

First, here's a chart of the Pound Index and the pound position amount.

![]()

![]()

![]()

For more information on how to read a speculative muscle chart, please see this explanation.

Click here for more information on how to read the speculator chart!

投機筋チャートとは大口投機筋・機関投資家・レバレッジファンドの「相場を操る御三家」のポジション量をまとめたチャートになります。

また相場を操る御三家に加え、小口投機筋のポジション量も掲載しています。

![]()

オーリー

投機筋チャートでは普通のチャートからは見ることができない、中長期的な相場の動きを見ることができます^^

相場を操る御三家について

大口投機筋・機関投資家・レバレッジファンド → 大口資金で動かす存在でチャートの動きに大きく影響を与える。

小口投機筋 → 個人投資家のことであり、相場の操る御三家に比べて資金力は圧倒的に不利。

![]()

オーリー

小口投機筋は資金力で不利なことから、相場を操る御三家の動きによってロスカットを喰らいやすい傾向にあります。

投機筋チャートはCFTCという海外のサイトからデータを取っており、それを和訳した上でチャートにまとめています。

ここで投機筋チャートで掲載しているポジション量は「NETポジション」という形式を採用しています。

![]()

オーリー

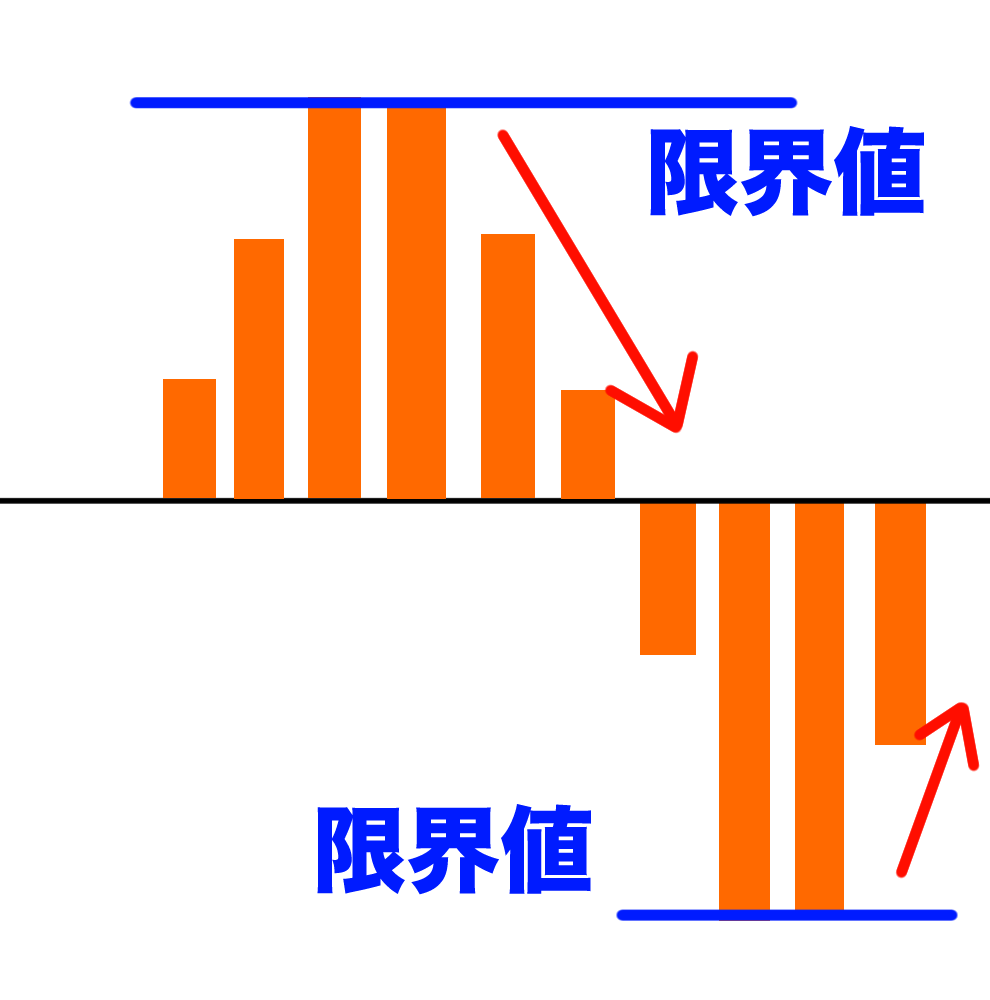

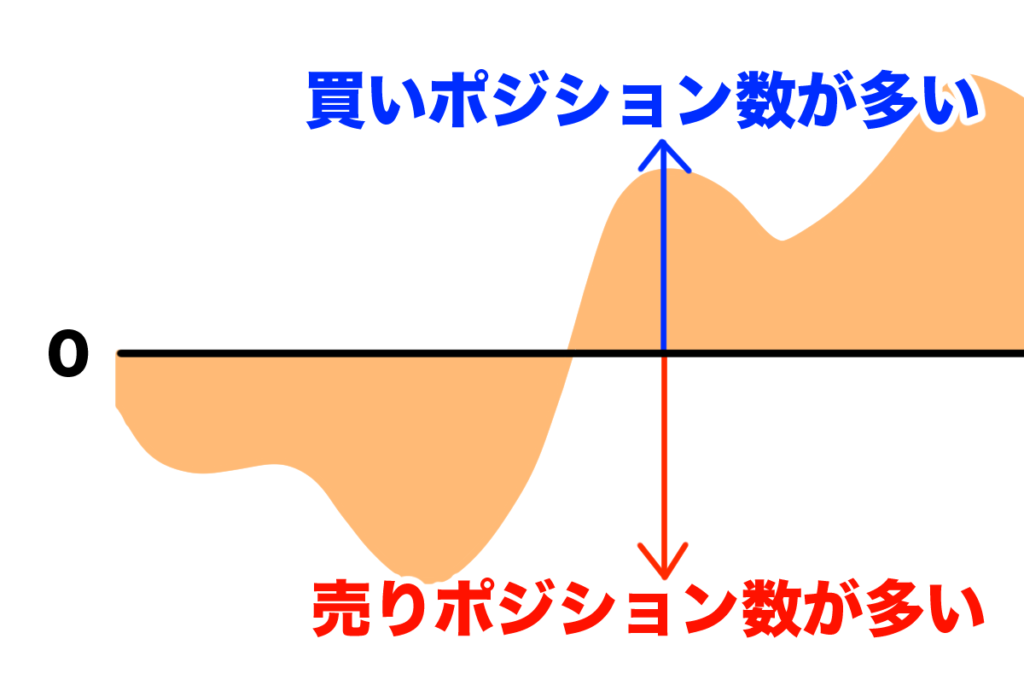

NETポジションとは、買いポジション数から売りポジション数を差し引いたものになります。

NETポジションの定義

・NETポジション = 買いポジション数 − 売りポジション数

NETポジションは0より上、すなわちプラスの値を取ると買いポジション量が多いということになります。

逆に0より下、つまりマイナスの値を取ると売りポジション量が多いということになります。

![]()

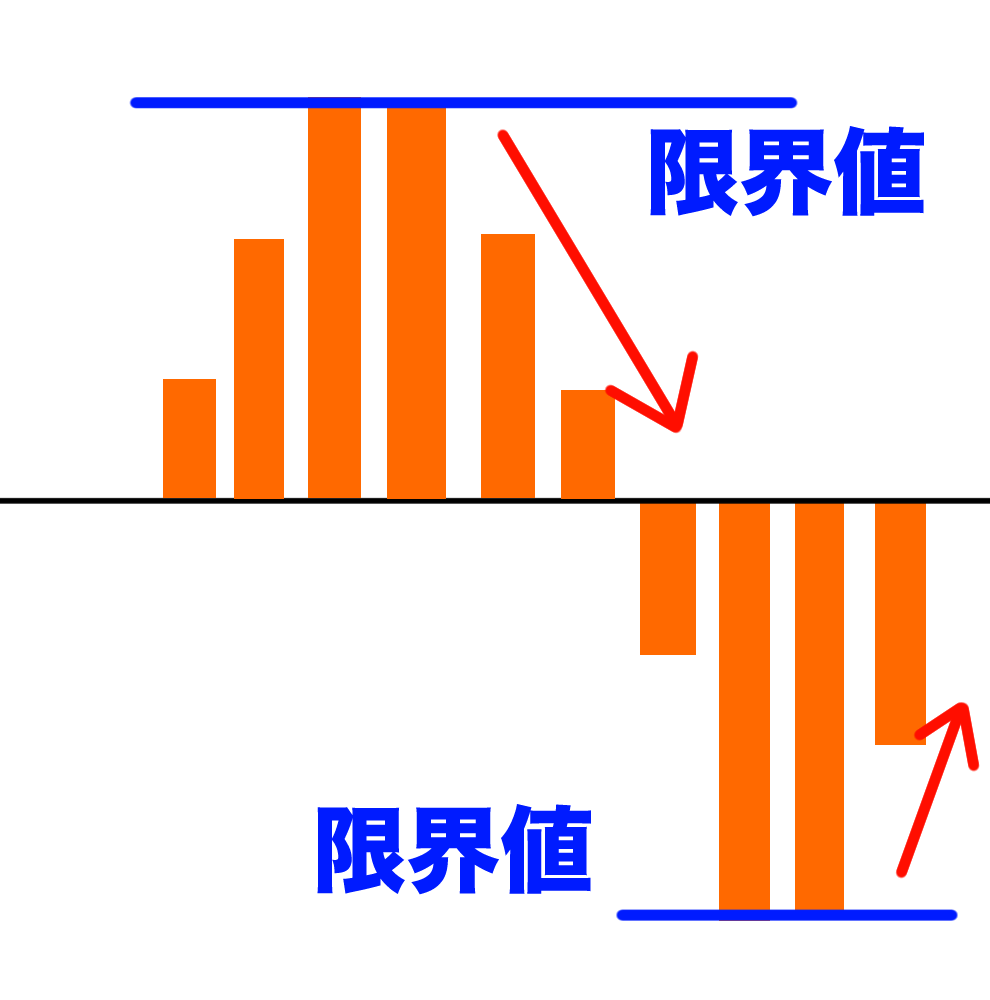

またNETポジションには限界値が存在し、限界値に当たると反発する傾向があります。

![]()

次に投機筋チャートの見方は以下のようになります。

![]()

![]()

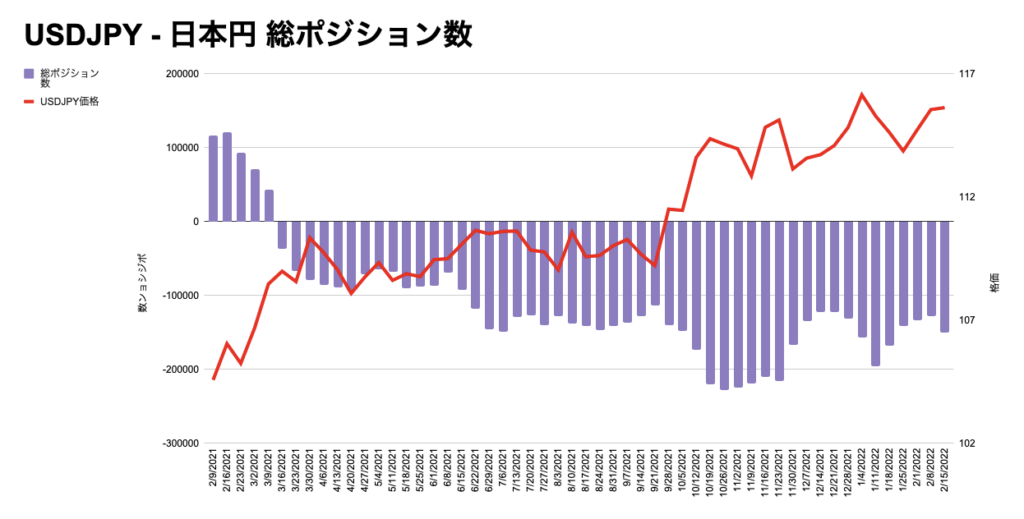

ブログで公開している投機筋チャートにはもう一つ、総ポジション量チャートがあります。

総ポジション量は全NETポジションを合計したものになります。

![]()

ブログで公開している投機筋チャートは一部除いて直近1年分のNETポジションをまとめています。

しかしMT4版であれば過去約10年分の投機筋チャートを使うことができます。

![]()

Yusuke-san

Where should I look for this?

![]()

Orli

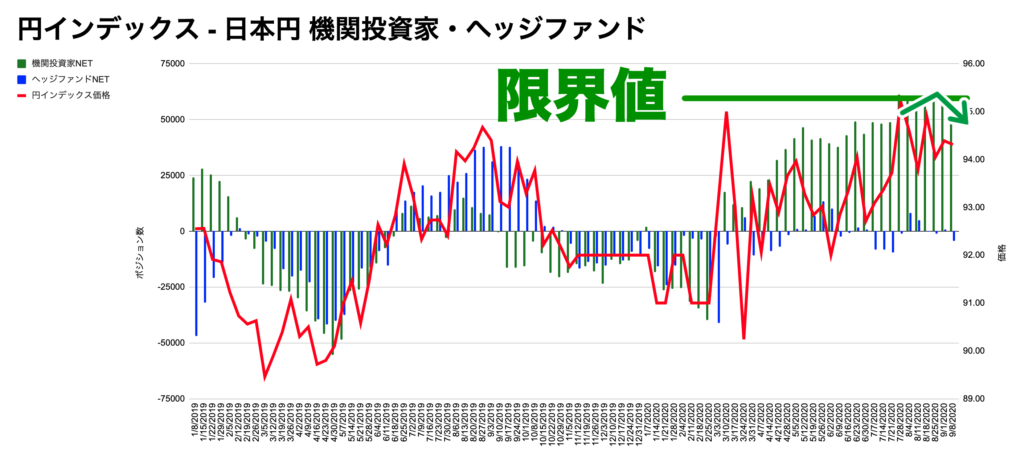

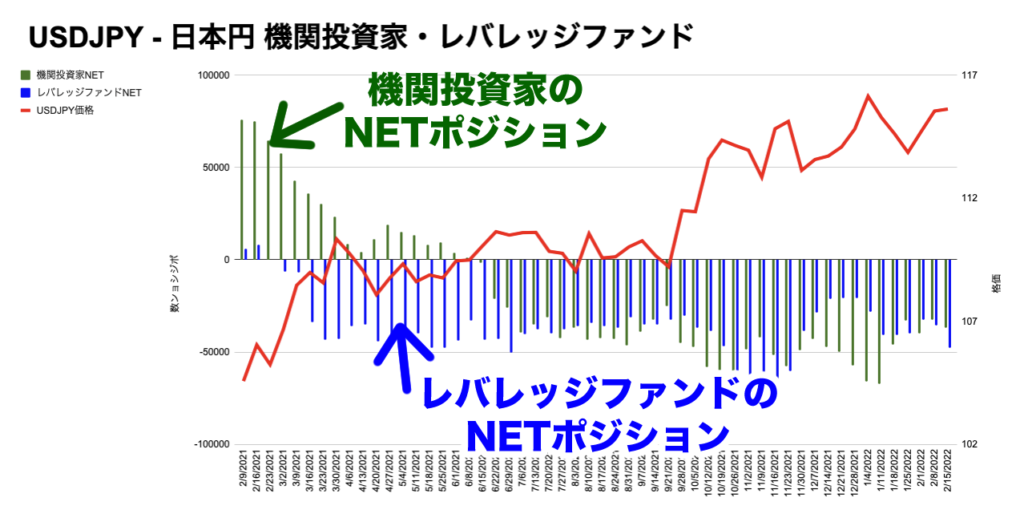

First, Institutional investors short (sell) the pound and we see that hedge funds are long (buy).

![]()

![]()

Yusuke-san

Eh, they're facing away from each other!

![]()

Yusuke-san

I wonder which one of these is the right answer!

![]()

Orli

So far, I'm not sure who is right, institutional investors or hedge funds Unclear.

![]()

Orli

Then I focused on the "speculative muscle line"

![]()

Yusuke-san

The speculative muscle line?

![]()

Orli

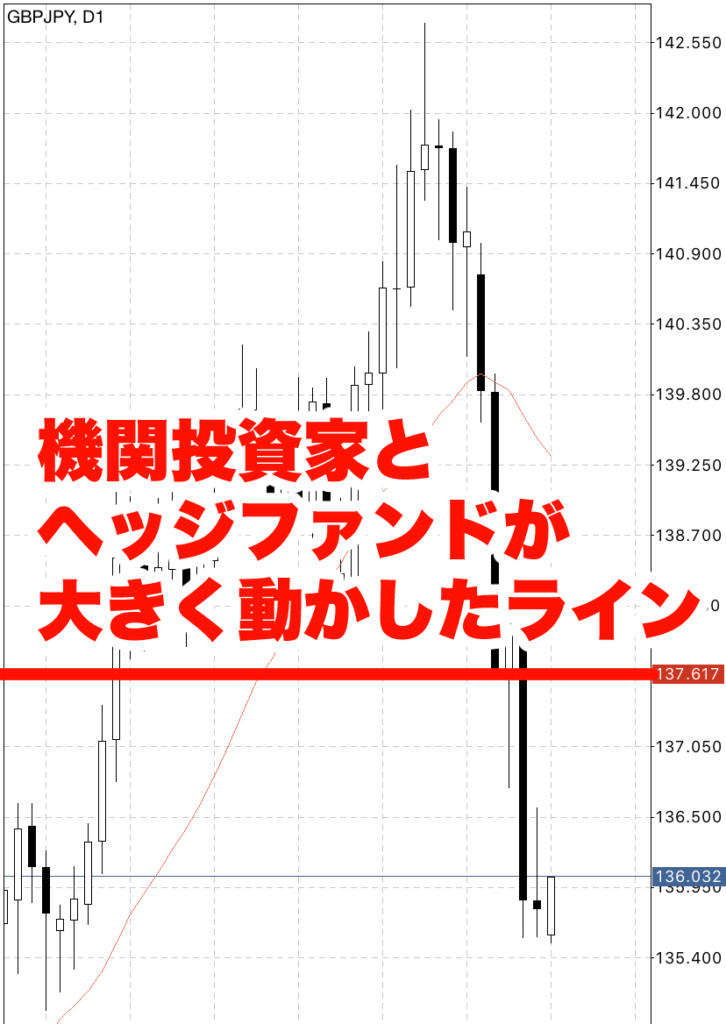

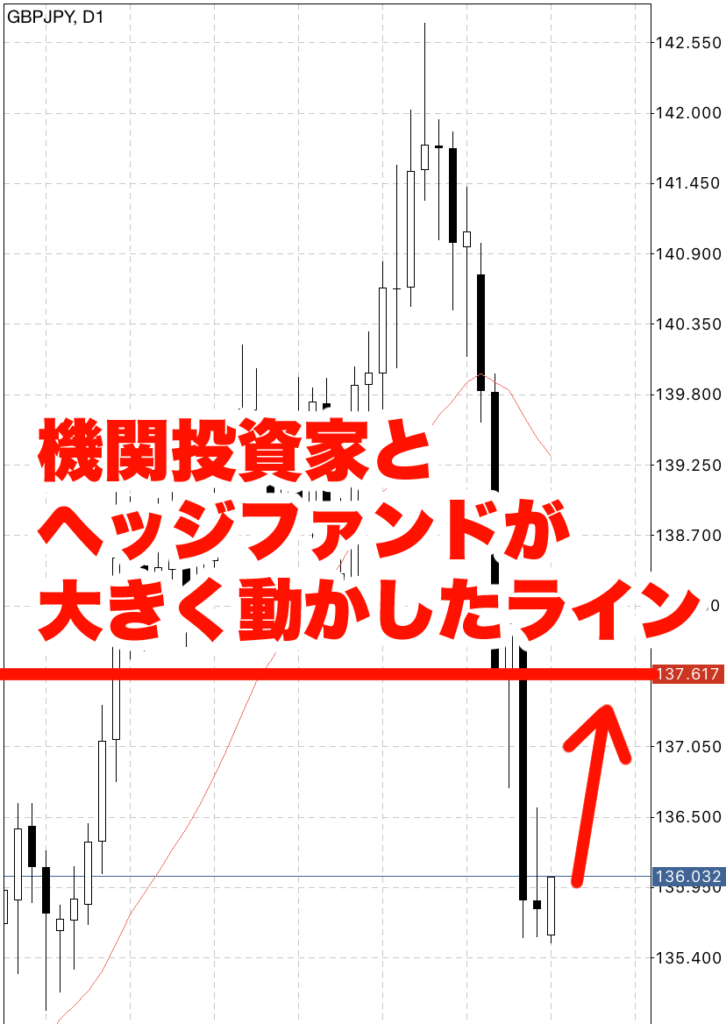

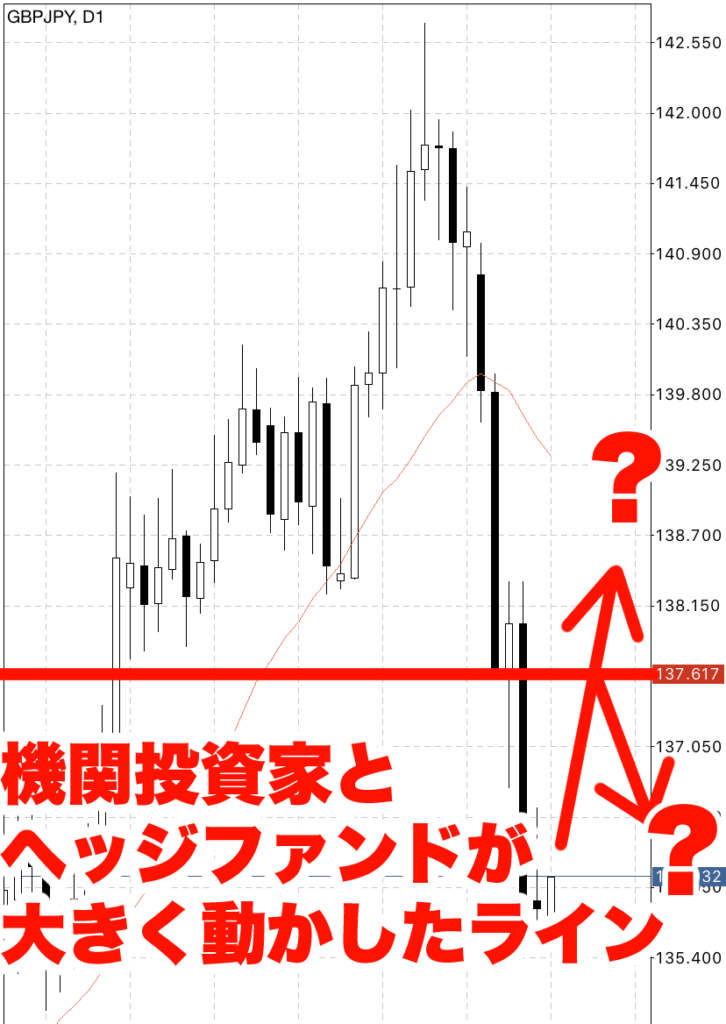

Here's a chart of the pound-yen, but the agency at 137.617 yen Investors and hedge funds may have made a big move.

![]()

Yusuke-san

This $137.617 is Is this 137.617 yen the speculative muscle line?

![]()

Orli

That's right!

![]()

Yusuke-san

Why did they come up with a figure of 137.617 yen!

![]()

Orli

Because position volume is aggregated by Tuesday's close, be aware of Tuesday's close We believe that this will be done.

![]()

Orli

So the closing price of the pound sterling on Tuesday was 137.617 yen It is.

![]()

Yusuke-san

I see! So that's what it was.

![]()

Orli

This week, against this speculative line of 137.617 yen, something We think it will be a conscious movement.

![]()

Orli

Imaginatively, we are looking at the possibility of a pause in the pound/yen up to around 137.617 yen in the first half of this week.

![]()

Orli

And later in the week, I'm wondering if we could see a move above or against the speculative line at 137.617 yen around the Bank of England pOrlicy rate (BOE) We are there.

![]()

![]()

Yusuke-san

I see!

![]()

Yusuke-san

Oh, when you say pound sterling yen, you also include the yen.

![]()

Yusuke-san

What about the speculative muscle chart of the yen?

![]()

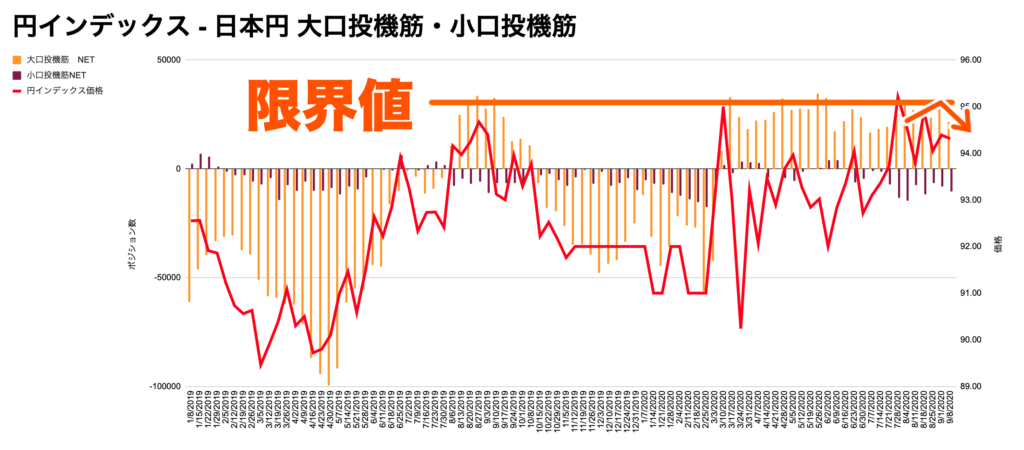

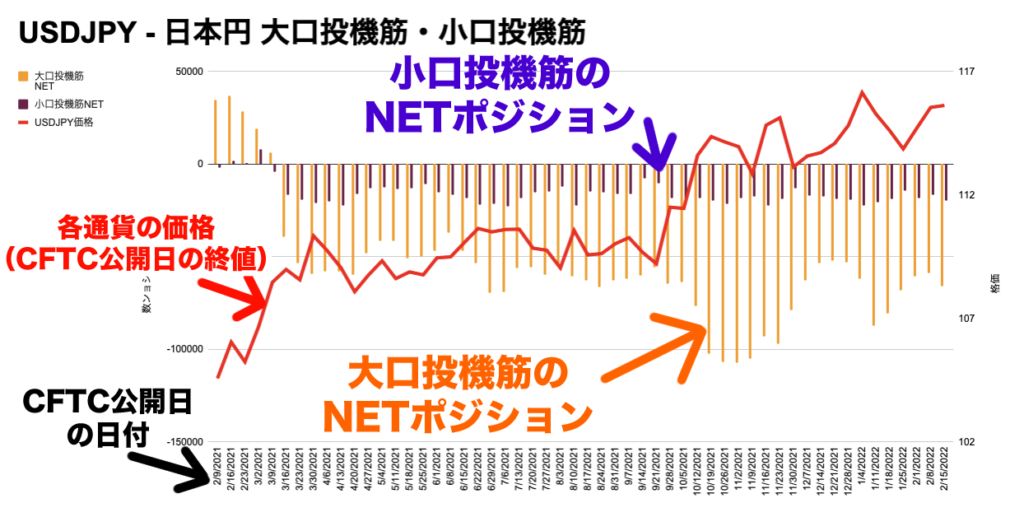

Orli

Here is a chart of circular index and The amount of the circle position.

![]()

![]()

![]()

![]()

Orli

I think there should be a move towards shorting the yen as large speculators and institutional investors are hitting marginal values here.

![]()

Yusuke-san

Well, was it a rebound when you hit the limit?

![]()

![]()

Orli

You're well studied! When the yen sells off, the pound-yen rises, so this is another reason for the pound-yen to rise to around 137.617 yen.

![]()

Yusuke-san

I'm so convinced!

![]()

Yusuke-san

Well, I just remembered that a long time ago, Ollie said, "Pounds You said, "The circle aims for 100 yen," didn't you?

![]()

Yusuke-san

Does this idea still hold true?

![]()

Orli

Jusuke, you remembered it well!

![]()

Orli

I'll explain next!

In the long term, we're going to move towards 100 yen per pound!

![]()

Orli

The pound/yen we just talked about could rise to around 137.617 yen, which is quite Short term view.

![]()

Orli

On the other hand the idea of the pound/yen aiming for 100 yen with a long-term view is still Continued.

![]()

Yusuke-san

Why do you think it's continuing?

![]()

Orli

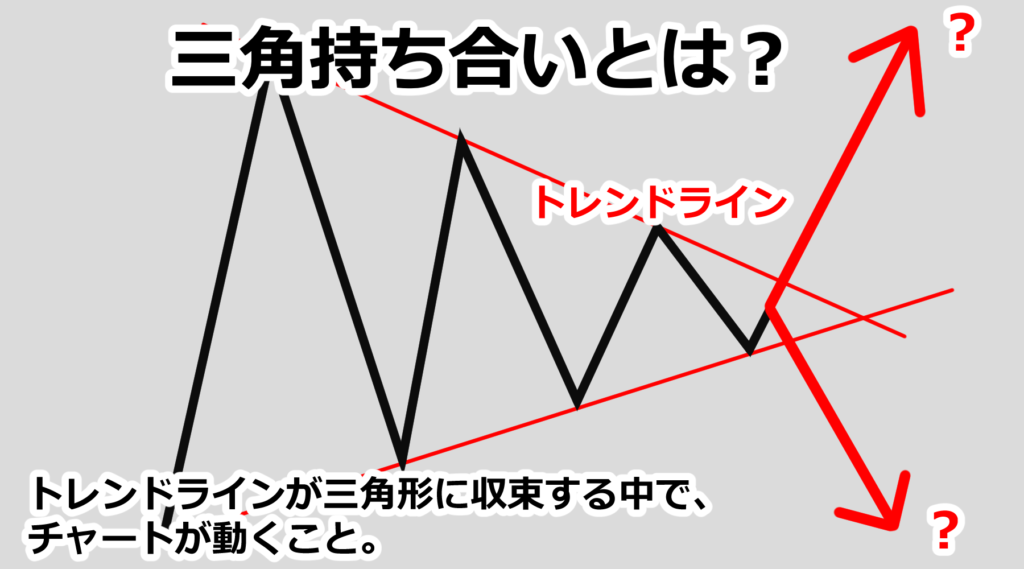

When you look at the monthly leg of the pound-yen, it's just triangular crosses We are looking at it as.

![]()

For more information about the triangle crossover, please see the explanation here.

Click here to learn more about triangle holding!

![]()

オーリー

三角持ち合いとは、上下対象にトレンドラインが収束する中でレンジで動く形のことを呼びます。

![FX,三角持ち合いの説明]()

![]()

Yusuke-san

Oh, it looks like they're pretty much holding each other up and converging.

![]()

Orli

When this triangle exchange ended and broke down, the pound yen dropped below 100 yen We're thinking about the possibilities of what we're aiming for.

![]()

Yusuke-san

I see! It's long term, so does that mean it could still take more than a few months?

![]()

Orli

That's right In some cases, it can take more than a year.

![]()

Orli

So it could be a few years before we know the answer, and I think we'll see this from the speculator chart in the future.

![]()

Orli

We'll discuss it in more detail then!

![]()

Yusuke-san

Okay! And while I'm at it, I'd like to see a speculator chart 10 years!

![]()

Orli

You can view the decade here.

→MT4版投機筋チャートで10年分を見る

![]()

Yusuke-san

Thank you!

![]()

Orli

Also, please watch this video for an explanation of the content of this article.

![]()

Yusuke-san

I'll review it thoroughly! Thanks again for the day!

In this article, we explained the movement of the Pound and Yen in FX from the speculative sources chart.

I hope this gives you an idea of the rationale for a possible major move in Pound as well.

I hope you use it for your future trades!

ブログの更新通知を受け取る

ページ左下のこちらのアイコンを押せば

ブログ更新時に通知を受け取れます!

(※iPhoneには対応しておりません。)

また、メルマガでもブログ更新のお知らせを配信しています。

ぜひこちらからご登録ください!

↓↓↓↓↓↓↓↓↓↓

最後までお読みいただきありがとうございます。

![The dollar could make a big move this week! FOMC Monetary Policy Announcement Explained! [FX]](https://orli-ch.com/wp-content/uploads/2020/09/874217_s-300x225.jpg)